Called the “location-based marginal price for carbon” (LBMPc), the NYISO said this past week the pricing model could appear as early as the spring of 2021.

Carbon pricing in New York state shook up the market for wholesale power since the discussions started after the New York Independent System Operator (NYISO) released this past December its final draft for carbon pricing.

Last Tuesday, the NYISO provided a bit more clarity on how this pricing mechanism would work. This mechanism would allow for a calculation of a Location Based Marginal Price for Carbon or, as the NYISO has termed it, an “LBMPc.”

The LBMPc will be calculated after a real-time market run to assess the societal cost of carbon to the users of electricity on the grid. The calculation of the LBMPc is straightforward and transparent, but still pretty complicated and beyond the scope of discussion in this article.

What are likely to be the impacts? Well, the NYISO included a few examples which they have deemed for “discussion purposes only” in their presentation.

The low end of the range provided was $0 per megawatt hour (MWh) for a trivial case, and a gas case provided an LBMPc of $20 per MWh. The high end of the range was $52 per MWh with a typical oil case coming in at $39 per MWh.

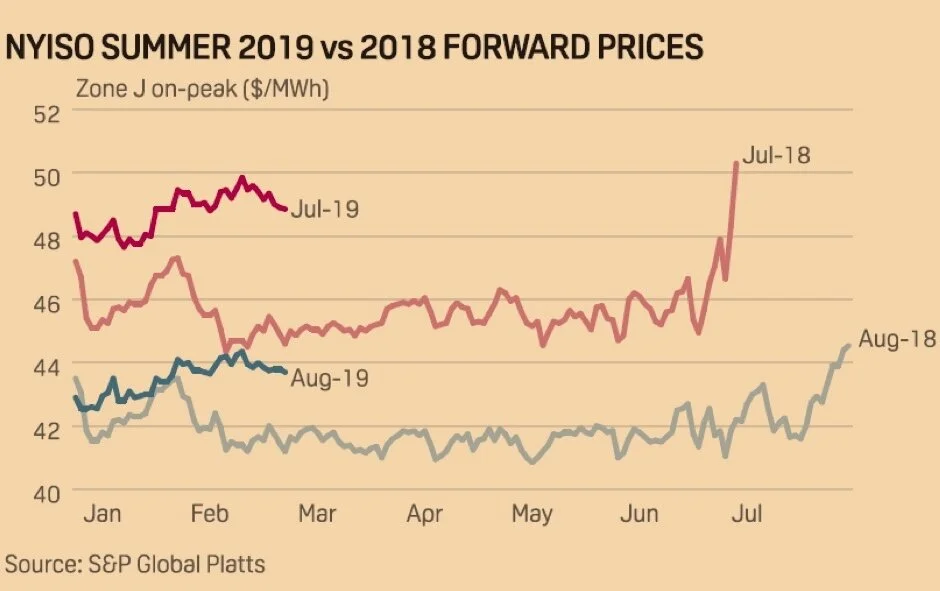

The market is trading with a premium of around $10 per MWh higher for power supplied after implementation versus before implementation. NYISO has reported that the earliest date for implementation would be spring of 2021. With all this said, the markets have not moved much at all since the presentation on Tuesday.

What should the retail electric customer do when facing a potential increase in the second quarter of 2021 of close to $10 per MWh? Our advice in this market is to continue to watch developments carefully, but make no commitment to energy prices beyond Q2 2021.

We also advocate that customers do long-term deals to lock in capacity prices now so that when an opportunity comes where there is more clarity on carbon pricing, the customer has a vehicle to transact quickly and efficiently.

Author: Mark Kleinginna